How it works

Support innovation – Investing in an ESIC made easy.

The Australian Government has brilliant incentives to encourage investment in innovative companies, but not many people know about the incentives, or how to utilise them.

At Attivare, we want to make it easier to invest, and easier to access these tax incentives so that more people support clever Australian companies.

The ESIC tax offset

The ESIC tax incentives qualify investors in ‘early stage innovation companies’ (ESICs) for a tax offset of up to $200,000 – equal to 20% of the investment – as well as modified capital gains tax treatment.

ESIC investing made easy.

- We source investment opportunities in innovative Australian start-ups that qualify as ESICs.

- We offer finance and structuring to facilitate and leverage your investment.

- We provide instructions and the documentation you need to claim the ESIC tax offset.

- We work with start-ups for the long term, providing financial oversight and governance to reduce risk to your investment.

You claim the tax offset in your tax return. To qualify for the offset:

- The company must qualify as an early stage innovation company. We provide you with the start-up’s ESIC certification documents to show that it passes the ATO’s early stage and innovation tests.

- Shares are allotted to you, subject to approval of the Startup’s Board. Share allotment is registered with ASIC and your share certificate is issued.

- The Startup files the ESIC share allotments and its ESIC qualifications with the ATO.

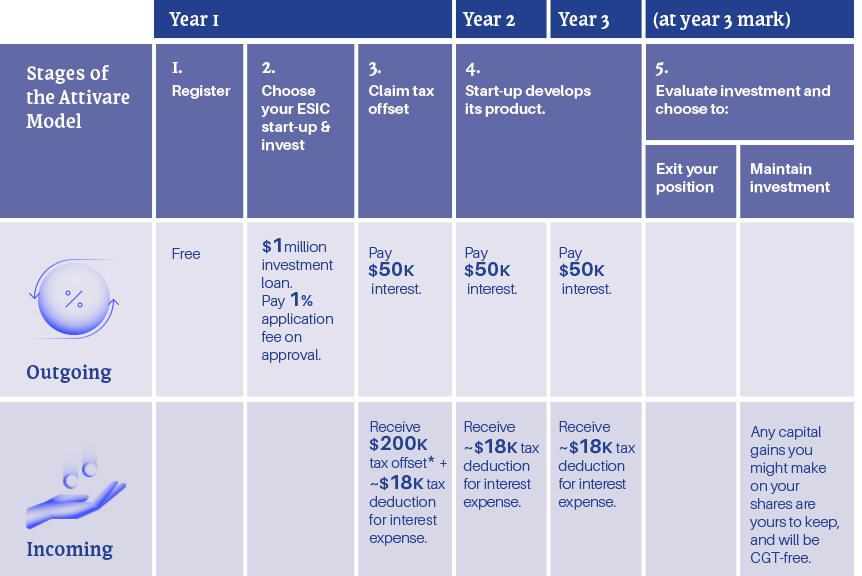

The Attivare model

Our investment model is tried and tested for product development and investment risk management.

Investors purchase shares and agree to hold them for three years. We offer a three-year, interest only loan to fund the investment.

Start-ups use this three-year period to develop a minimum viable product. During this program, Attivare prudently manages the start-up’s capital to preserve value in the start-up and protect investor interests. The start-up spends only its revenue on its product development.

At the end of the three years, investors assess the start-up’s product and decide whether to maintain their investment or exit their position. If they choose to maintain the investment, the start-up begins to spend capital in the growth phase. Otherwise, if investors exit, the IP is returned to the founder and the remaining capital is returned to the investors.

The above example assumes the standard $1m investment, financed through an interest-only loan, and an income tax rate of 37%.

*Your tax offset can be carried forward to offset future years’ income tax.

If you decide to continue with your investment in year four, the start-up will then begin to spend the full capital you invested to scale-up their operations. This provides a seamless transition from seed funding to series A funding.

Year four

At the beginning of the fourth year investors evaluate the start-up and the minimal viable product they have developed and decide whether to continue with their investment.

Maintaining investment

If investors continue, the capital is released to the start-up to use – transitioning the start-up into a growth phase. At this point the Attivare risk management ends, and investors move forward accepting full risk with their investment.

Exiting investment position

There are many exit strategies available at this point, including a Founder buy out of investors and a share buy-back. If the start-up is not to continue Attivare has efficient and cost effective strategies to wind up the start-up and return the remaining capital to investors.

Size of investment

The minimum investment in this program is $500,000. Our standard investment is $1 million, which attracts the maximum tax offset. You may invest more than $1 million, in which case the tax offset will apply up to $1 million of the investment, but you will get modified CGT treatment for the whole investment.

• A $500,000 investment attracts a $100,000 tax offset.

• A $1m investment attracts a $200,000 tax offset.

We have financing options to facilitate investments.

Financing

Financing makes investing a possibility for you if you don’t have cash on hand, but still want to support innovation and leverage your investment.

Our financing partner understands the Attivare model and the risk management that is built into the structure. As such, they offer financing for 100% of the investment, secured by the shares themselves.

Loans are interest-only, with the interest component payable annually either upfront or in arrears.

Additional tax benefits

Modified CGT treatment means that if your shares increase in value you will not have to pay capital gains tax on the profit when you sell them.

If you choose to finance your investment, the interest payable on your loan is a tax deductible expense. For instance, $50K in interest each year is a $50K deduction, which equates to around $18K off your tax bill (assuming the .37c tax bracket).

These are general comments and you should contact your tax professional for specific advice.

Upfront cash required to participate

If you choose to finance your investment, you will need to pay the application fee upfront, and the interest on your loan. The interest can be paid upfront, or in arrears. If paid in arrears then it may be tailored to your cash flows.

For our standard investment, the upfront cash required is $10K application fee, and $50K interest.

If you are self-financed, then the total investment amount is required to pay for your shares upfront.

Our fees

It is free to register and browse investment opportunities. A 1% loan application fee is applied to approved loan applications. For example, a $1 million investment would include a $10,000 fee.